Industry Survey Results

90% of Firms Support FCA’s MiFID Reform: Lower Costs, Leaner Reporting

Author:

Michelle Zak

Author:

Michelle Zak

Managing Director

20th January 2026

Following the FCA’s Consultation Paper, CP25/32: Improving the UK transaction reporting regime , Qomply’s 2026 industry survey reveals that 90% of firms expect the FCA’s proposed MiFID transaction reporting reforms to reduce costs and streamline compliance. The findings highlight strong industry support for simplifying reporting scope, data requirements, and operational complexity under the UK’s future reporting regime.

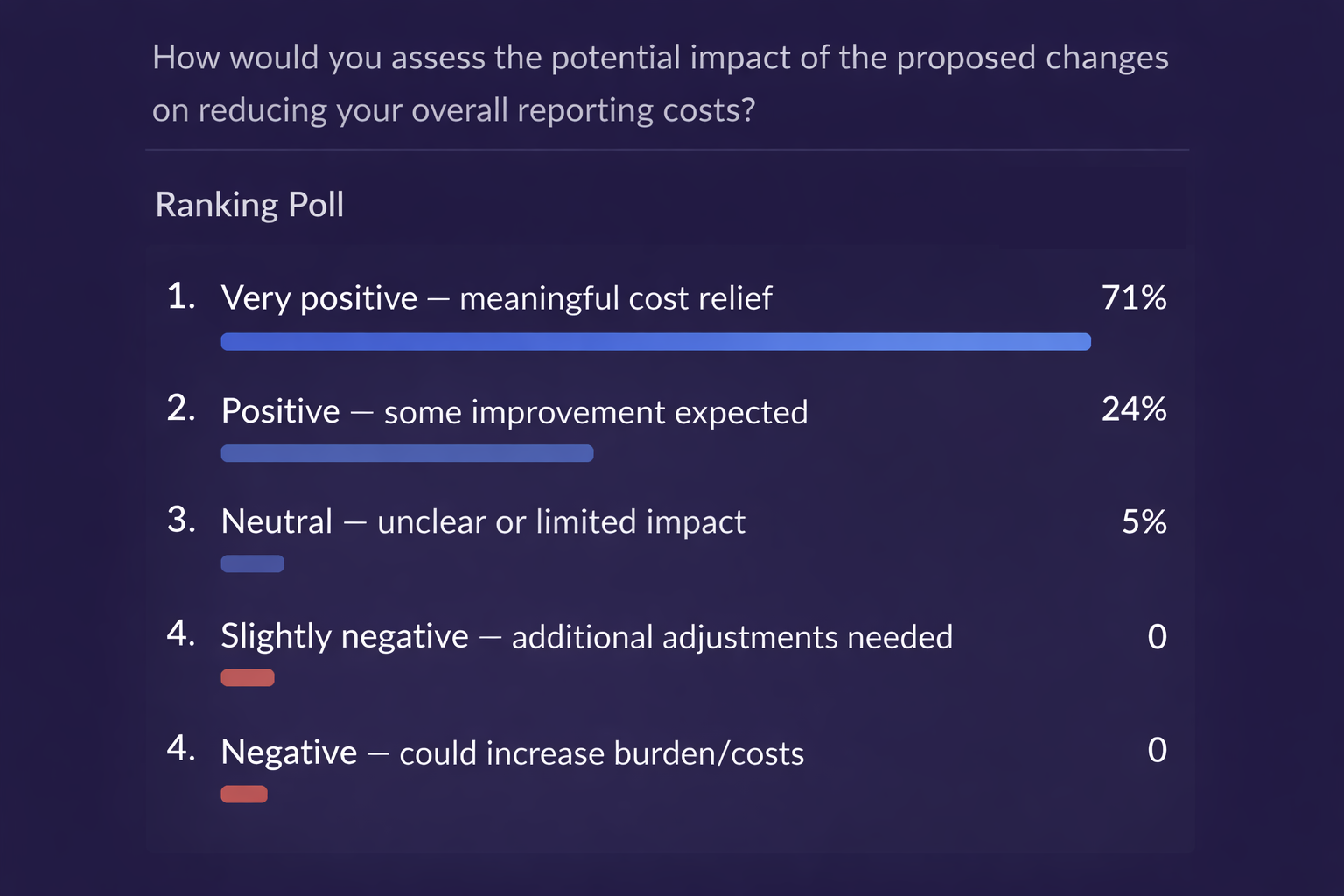

A recent Qomply survey of market practitioners shows strong confidence that the FCA’s proposed changes to the UK MiFID transaction reporting regime will reduce reporting costs. Most respondents expect a positive or very positive impact, and notably, none anticipate an increase in costs.

This sentiment suggests the FCA has struck the right balance. More than seven years after MiFID II went live, the regulator is now signalling a measured reboot of the UK’s reporting obligations.

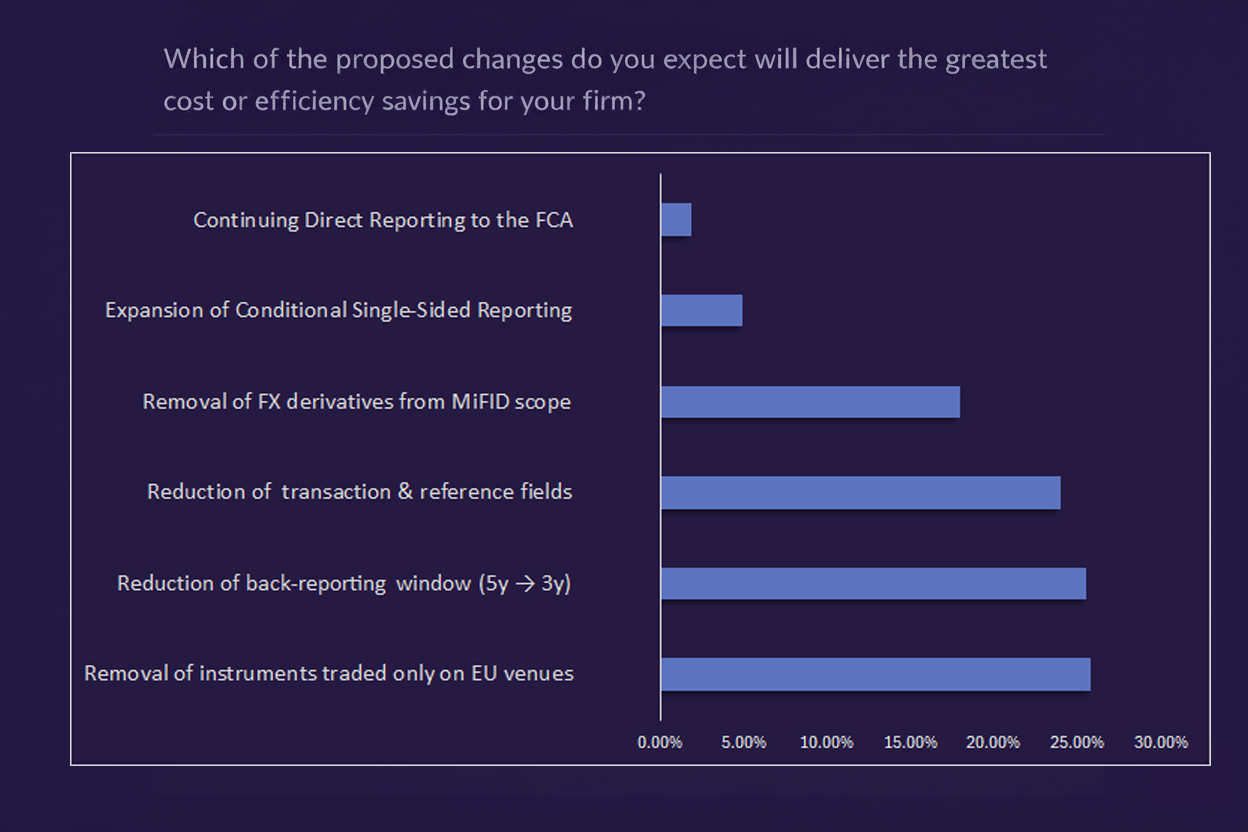

When Qomply asked which reforms would generate the greatest efficiency gains, responses clustered around four key changes:

- Removing instruments traded solely on EU venues

- Reducing the back-reporting window from five to three years

- Reducing the number of reportable and reference-data fields

- Removing FX derivatives from MiFID transaction reporting scope

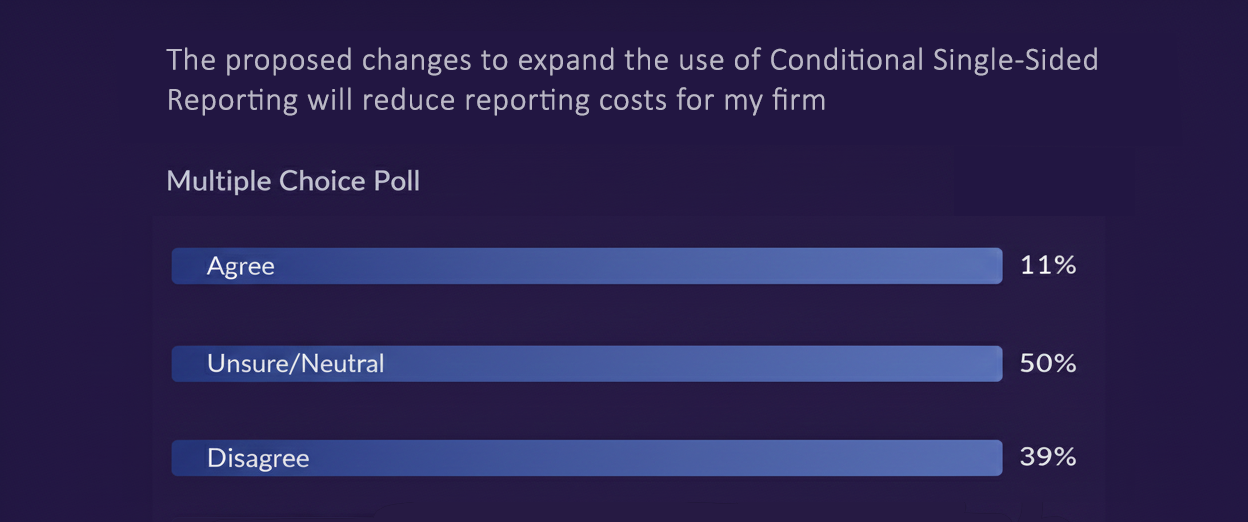

The FCA is also proposing a more flexible approach to Conditional Single-Sided Reporting (CSSR) to encourage greater industry uptake. However, the survey reveals deep scepticism—around 90% of respondents questioned whether CSSR will deliver meaningful benefits. Market adoption may ultimately depend on how sell-side firms and venues respond, and at what commercial cost to counterparties.

Responses to the FCA consultation are due by 20 February 2026.

For a more indepth perspective of the proposed reforms and their practical implications for firms, see Qomply’s overview:

Key Proposed Changes to Improve MiFID (CP25/32)

You can also read the FCA’s consultation paper in full here: Consultation Paper (CP25/32): Improving the UK Transaction Reporting Regime