Checking if Instrument is Reportable

Resolving the CON-412 Rejection Code

MiFID Transaction Reporting | Troubleshooting

Updated By: Sophia Fulugunya

Updated By: Sophia Fulugunya

Director of Transaction Reporting

12 May 2021

Updated 24 April 2024

According to the FCA, nearly 60pct of rejected transactions are due to the instrument not being found in their Financial Instruments Reference Data System (FIRDS) database.

MiFID firms submitting transaction reports will be familiar with the CON-412 rejection code – the error code assigned by ESMA, the originators of the MiFID body of regulations. The CON-412 error states: “Instrument is not valid in reference data on transaction date” and is well-known amongst regulatory operational specialists monitoring transaction reports.

The CON-412 error is received when the report falls under one of the two scenarios:

1. The instrument is not present in the FIRDs reference data

2. There is no reference data, in FIRDS, for that instrument from the venue reported on the trade date

Even though firms have had over six years to embed processes, the CON-412 rejection code continues to be a pain point for operations and compliance departments. In 2018, at the start of MiFID, over 37pct of rejections were due to this error. In 2019, this skyrocketed to nearly 70pct of rejected transactions being assigned this error only to drop back down to over 57pct in 2020.

How do firms avoid or resolve this issue? The first port of call would be to conduct due diligence in ensuring the transaction is reportable and present in FIRDS.

A free tool by Qomply can help. The cloud-based tool retrieves instrument data across all UK and EU trading venues and instantly confirms whether an instrument is reportable on a specific date. If the instrument is not reportable, and there are no underlying instruments, then the transaction should not be submitted to the regulator as it would be considered “over reporting”.

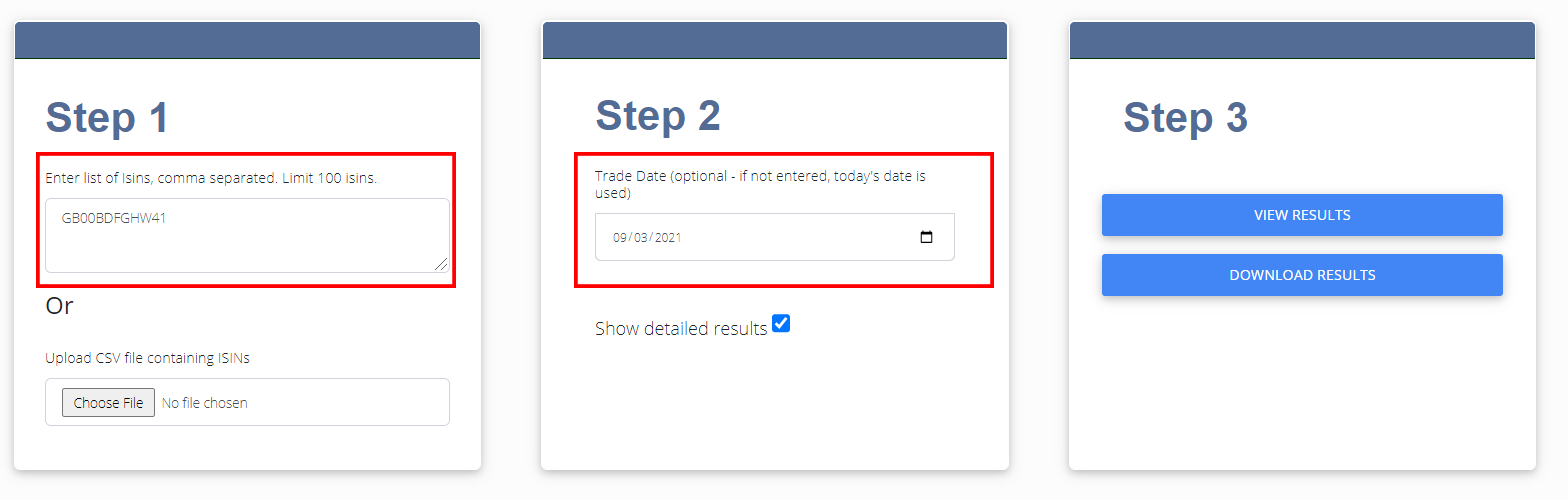

Step 1 Search Instrument in FCA and EU FIRDS

Access the Tool

https://qti.qomplypi.com/firdslookup

Enter ISIN to Check Across UK and EU Databases

In our test, we use ISIN GB00BDFGHW41

Click View Results

The Trading Venues on which this instrument was tradable for today’s date are shown.

Determine Reportability

To determine if a particular instrument was considered reportable on a trade date, enter the ISIN and the Trade Date in Step 2 on the screen. If a date is not entered, the system will retrieve data for today.

The results show whether the instrument is reportable in the UK and/or reportable in the EU alongside the Trading Venue on which it was active.

Additional details such as the Trading Venue, to which the instrument was admitted, also appears. For firms who traded the instrument on a trading venue this is useful. If you traded the instrument on a trading venue and it is not listed in the results, then contact the trading venue to ensure they submitted the reference data to FIRDS – an obligation they have under RTS23 of MiFIR.

If an instrument is traded XOFF (field 36 venue of the transaction report), then the instrument should be reportable on at least one trading venue in the region.

If an instrument is traded XXXX (field 36 venue of the transaction report), then the instrument should not have been admitted to trading in the region. That is, using the example above, in column “Reportable in the UK” we should not see TRUE in any of the rows.

Step 2 Advanced Tips and Tricks

Get Results for a Specific Trade Date

This feature is especially useful when troubleshooting historic transaction reports.

To go back in time to a specific trade date to determine reportability on that date, enter the ISIN, enter a trade date, and click VIEW RESULTS.

Get Results for Multiple ISINs

To conduct efficient searches across multiple ISINS for the same trade date, simply enter a series of ISINS separated by a comma. Enter the trade date and click VIEW RESULTS.

Get Results for Multiple ISINs in a CSV file

From page https://qti.qomplypi.com/firdslookup, select the CSV file from your local machine, enter a trade date and click VIEW RESULTS.

Download Results

Instead of viewing the results on the screen, it may be more helpful to download the results to a CSV file. This is especially true when entering more than one ISIN. Run the search as normal however instead of clicking VIEW RESULTS, click DOWNLOAD RESULTS.

Free Events, Tools and Information Directly to Your Inbox

Quality Assurance in a Click

MiFID II regulations requires firms to have arrangements in place to ensure transaction reports are complete and accurate.

Perform Quality Assurance on your transaction reporting through Qomply's cloud-based ReportAssure Suite. Qomply performs accuracy, timeliness, and completeness checks providing assurance that transaction reporting systems are working correctly.

Checks can be done before or after sending to the regulatory or ARM. Qomply's platform is built to respond to increasing levels of complexity of regulation, rules, and data analytics. Qomply's tools offer straight-forward interfaces and streamlined APIs enabling market participants to either use as a stand-alone products or integrate within their existing technical infrastructure.

If you are looking to conduct your own periodic quality assurance, accuracy, completeness, and timeliness checks, then the ReportAssure Suite puts One Thousand Checks at a Click.

Qomply in a Click