Overview of Qomply Solutions

Regulatory reporting requirements have increased significantly over the last 10 years, imposing a significant burden of cost and complexity on investment firms.

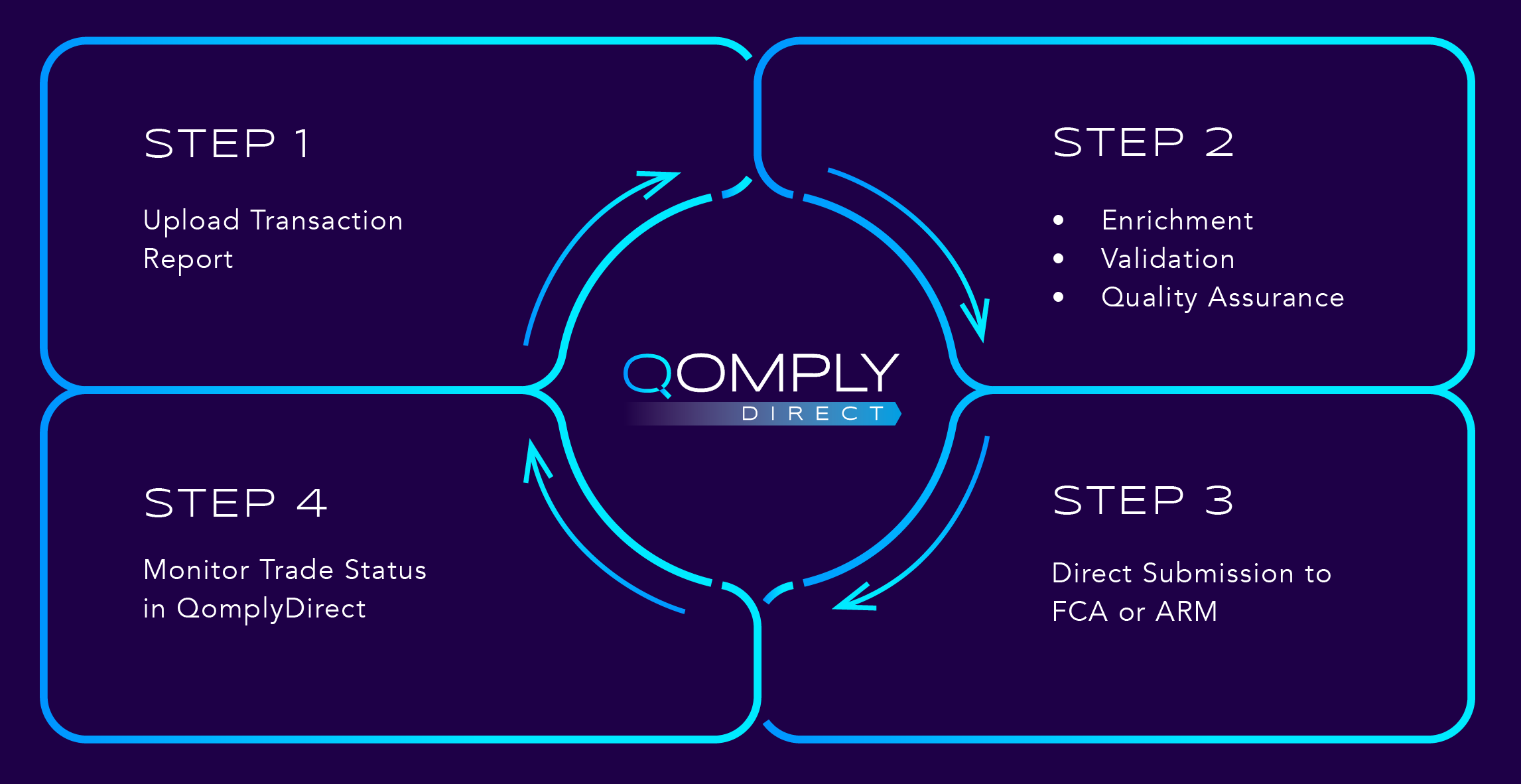

Qomply’s ReportAssure platform performs accuracy and completeness checks across MiFID, EMIR, CFTC, CSA, HKMA, SFTR, MAS and ASIC. Qomply provides peace of mind to investment firms, relaxed in the knowledge that they are meeting their regulatory requirements.

Qomply’s unparalleled accuracy means that firms get their transaction reporting right the first time.

By removing costly transaction reporting fees and increasing operational efficiency, Qomply empowers firms to take control of the quality of their transaction reporting.