MiFID XXXX vs XOFF for OTC Trades

RTS 22 Trading Venue Field

Qomply's Free Tools Simplify the Process

Author: Sophia Fulugunya

Author: Sophia Fulugunya

Director of Transaction Reporting

3 September 2025

Updated 18 January 2026

MiFID Transaction Reporting | Troubleshooting

Determining between XXXX and XOFF for Over-the-Counter transactions

Unsure whether to populate XXXX or XOFF for OTC trades under MiFID transaction reporting? This guide explains the rule in RTS 22, the key UK vs EU differences in ToTV, and provides worked examples to help you choose the correct trading venue value for your reports.

We often see firms struggle with the population of the venue field under RTS 22 transaction reporting. This is especially an issue where the trade has been executed off-venue or over-the-counter (OTC) as it is commonly referred. The question arises: do I populate XOFF or XXXX.

We can all agree that the text within the RTS could be clearer and hope that there will be improvements post regulator reviews both in the UK and EU. In the meantime, it's essential to understand the criteria for when XOFF and XXXX classifications become applicable:

XOFF – Is populated where the OTC trade relates to a ToTV (Traded on a Trading Venue) instrument (one that is available for trading on an OTFs (Organised Trading Facility), MTFs (Multilateral Trading Facility) or RMs (Regulated Market). This indicates that the trade was executed off-venue but is related to a financial instrument available for trading on a venue.

XXXX – Is populated where the instrument is brought into scope by the underlying and is traded OTC. This indicates that the trade was executed off-venue and is related to an OTC derivative, index or basket where at least one of the underlying instruments or constituents is available for trading on a venue.

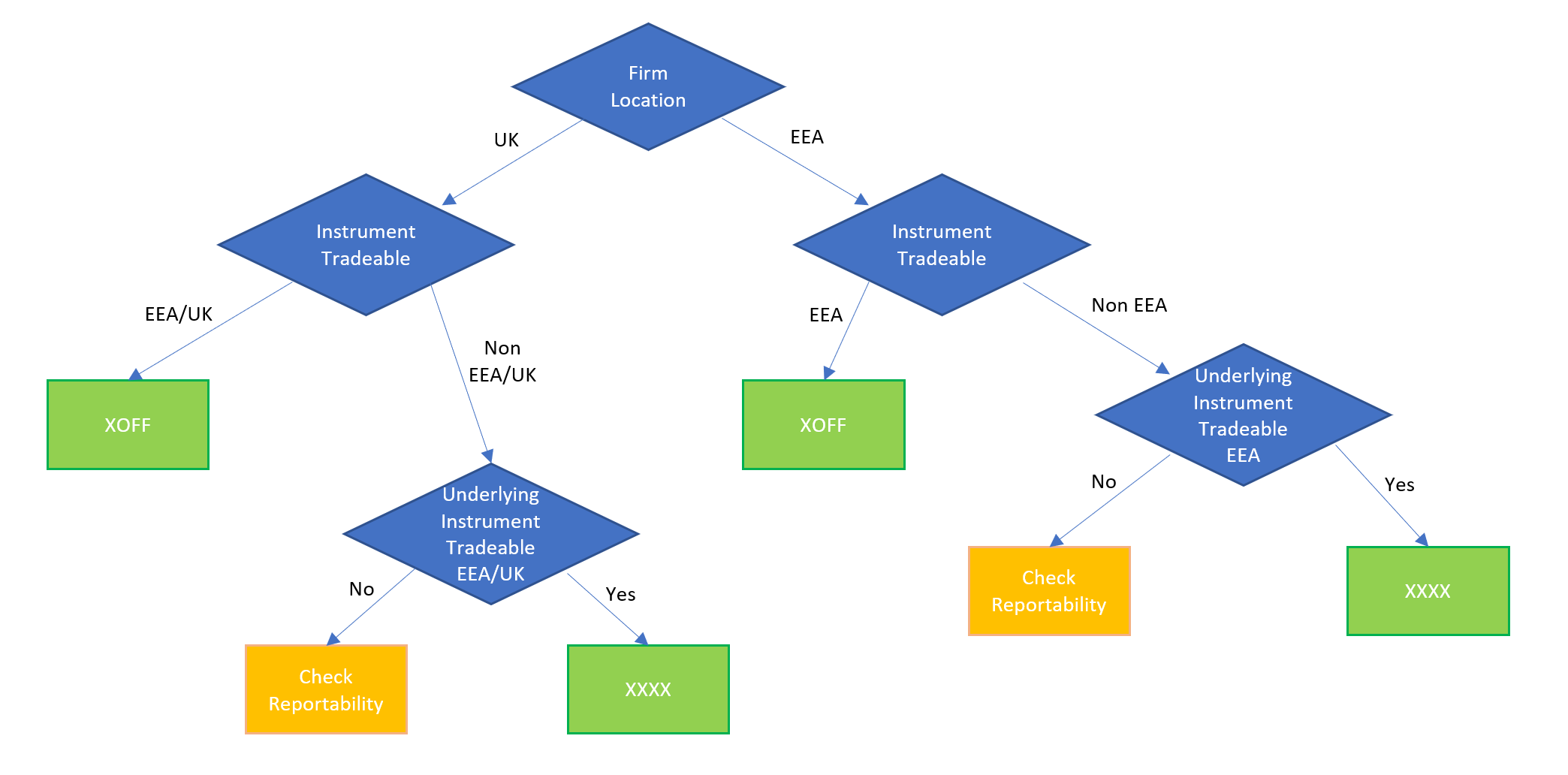

There is the matter of the difference in what constitutes a trading venue under EU and UK MiFIR.

• Under EU MiFIR ToTV applies to EEA trading venues

• Under UK MiFIR ToTV applies to UK, EEA and Gibraltar venues

Trading venues refer to OTFs, MTFs and RMs. Systematic Internalisers (SIs) are not trading venues therefore if an instrument is traded only on SIs, the instrument would not be considered TOTV.

XXXX and XOFF are different in the following way:

For reporting to the FCA in the UK:

• For OTC transactions on instruments that are NOT ToTV on a UK or EEA trading venue (ToTV) but the underlying instrument is ToTV in either jurisidicaiton, report the Trading Venue as XXXX

• For OTC transactions on instruments that are ToTV on a UK or EEA trading venue, report the Trading Venue as XOFF

For reporting to an EU National Competent Authority (NCA):

• For OTC transactions on instruments that are NOT ToTV on an EEA Venue but the underlying instrument is ToTV, report the trading venue as XXXX

• For OTC transactions on instruments that are ToTV on an EEA venue, report the trading venue as XOFF

To help in understanding the subtle differences, the flowchart below summarises the process in deciding when to use XXXX of XOFF for UK and EEA firms.

Click here to view a step-by-step walkthrough of examples of XOFF and XXXX transactions.

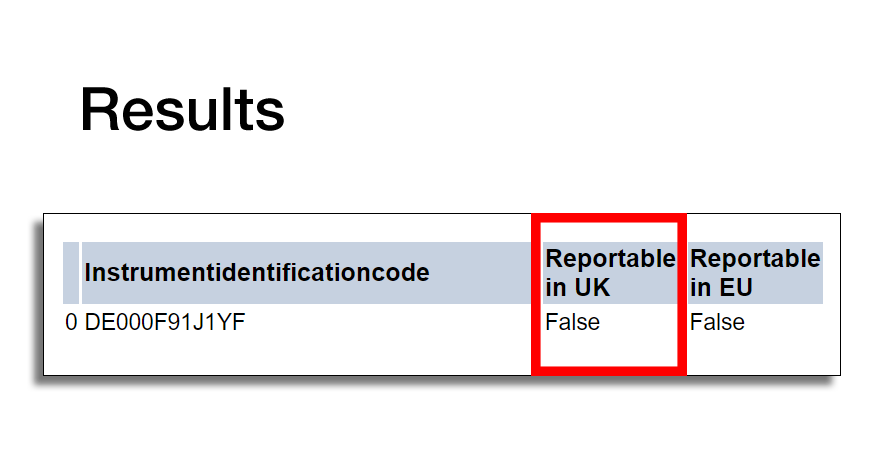

To determine which of XXXX or XOFF to use, you can use the freely-available Qomply FIRDS lookup tool to establish whether an instrument was tradeable on a venue in the UK or EEA at a given date.

The video above takes you through using this tool.

Example of XOFF | Firm located in the UK and executing OTC in the UK

Access the Tool

https://qti.qomplypi.com/firdslookup

In order to determine XXXX or XOFF, first determine reportability

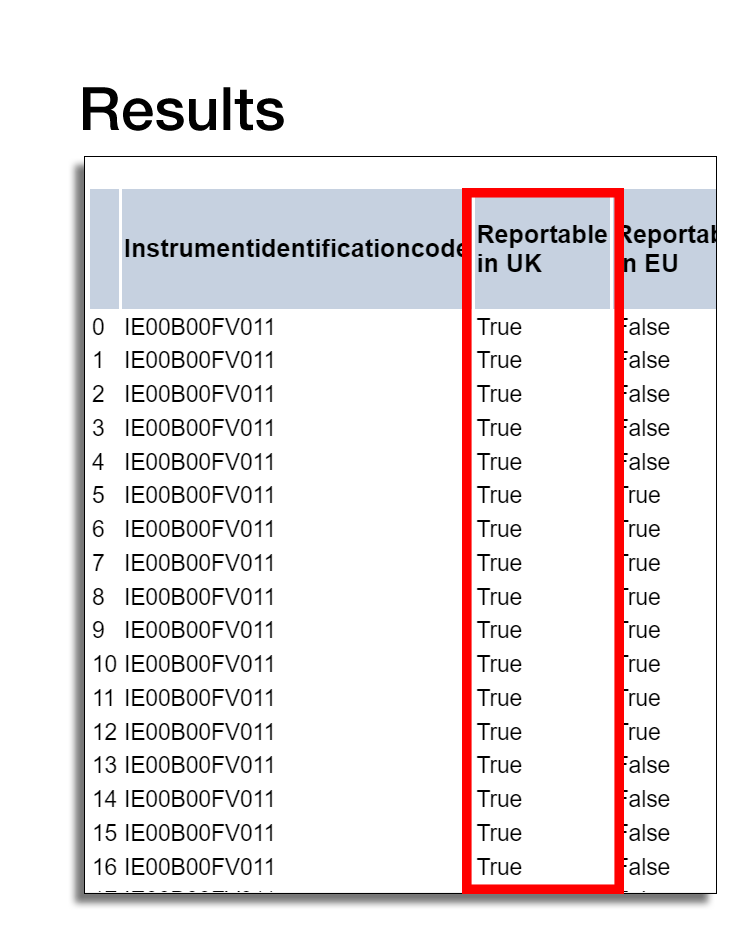

To determine if a particular instrument was considered reportable on a trade date, enter the ISIN and the Trade Date of 10-01-2022, as shown in the image below. If a date is not entered, the system will retrieve data for today.

In our test, we use ISIN IE00B00FV011

The results show whether the instrument is reportable in the UK and/or reportable in the EU alongside the Trading Venue on which it was active. If you are reporting to the UK regulator then you are only interested in whether the instrument was reportable in the UK. Therefore, if TRUE appears at least once in the “Reportable in UK” column, the instrument is reportable.

Since the instrument was reportable (as we see TRUE in the Reportable in the UK column) and traded OTC, then in this example we would report the trading venue as XOFF.

Free Events, Tools and Information Directly to Your Inbox

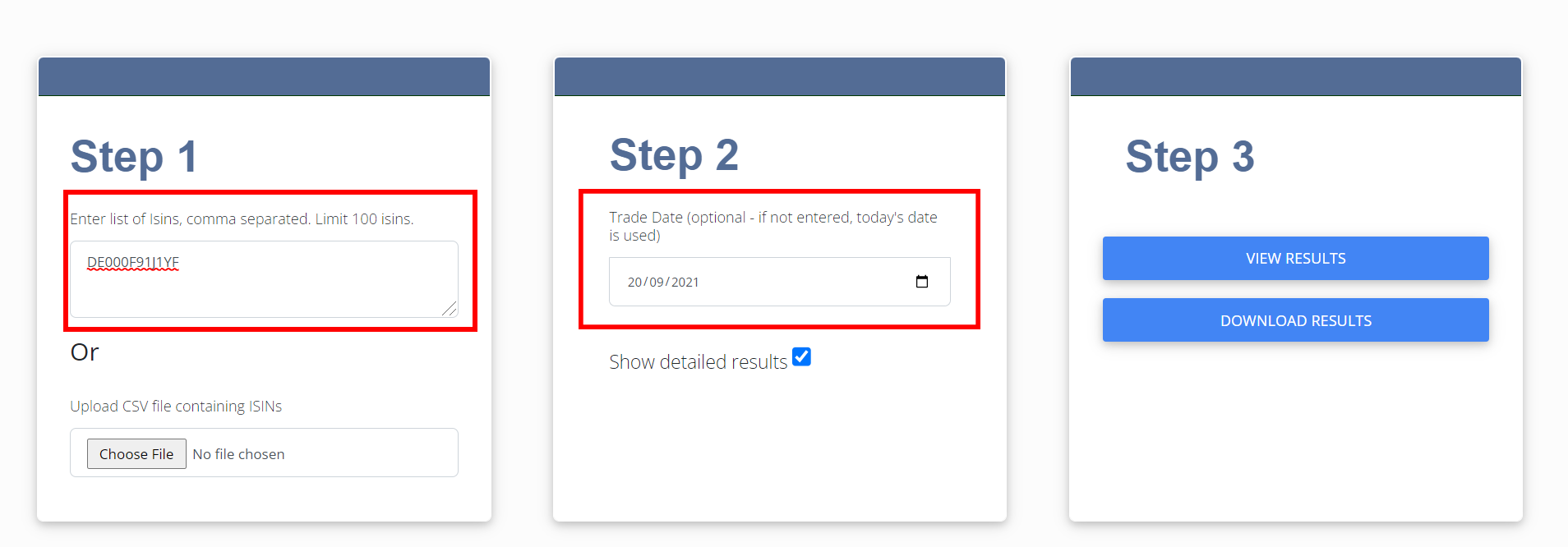

Example of XXXX | Firm located in the UK and executing OTC in the UK

In this example, we will illustrate the use of XXXX.

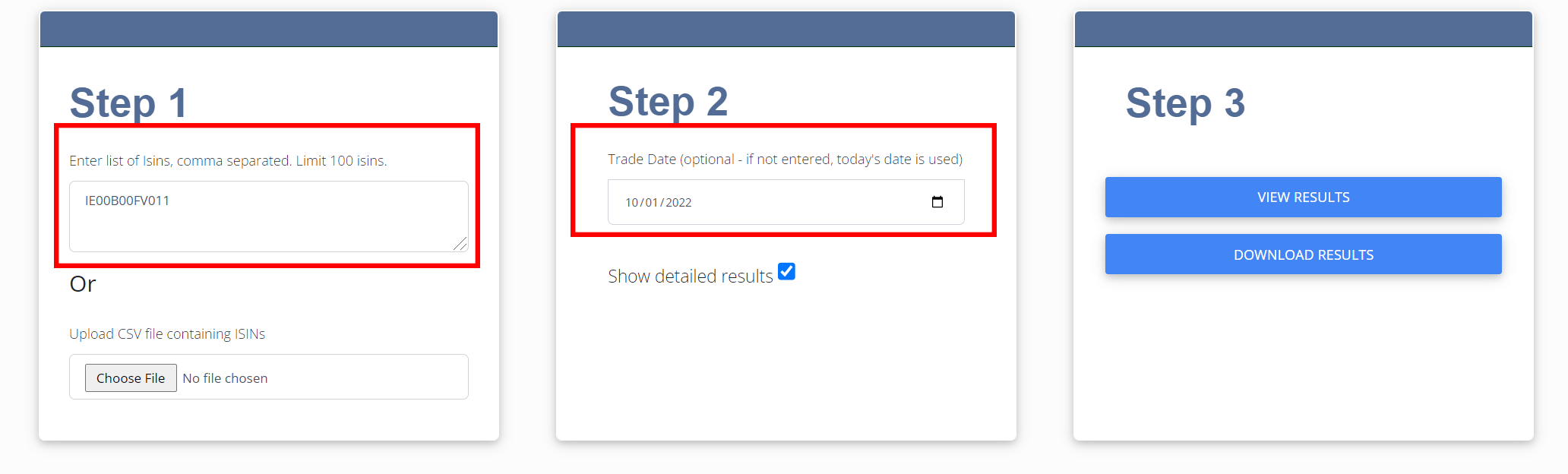

As seen in the image below, we will use ISIN DE000F91J1YF and Trade Date of 20-09-2021.

For this ISIN and trade date, the results show that the instrument is not reportable. We know this because the "Reportable in the UK" column contains one value: False. This means for a UK-based firm trading OTC in the UK, this instrument is not reportable. However, let's say that this transaction has one underlying ISIN: IE00B00FV011.

Following the flowchart above, we know that we must check each underlying instrument of the transaction to determine reportability.

We would repeat this process for each underlying instrument. In doing so, we can see that the underlying instrument is reportable for the trade date of 20-09-2021.

Therefore, since the underlying instrument is reportable and the transaction was executed OTC, we use XXXX as the trading venue.

If none of the underlying instruments is reportable, then the transaction would be considered out of scope for the purposes of MiFID II transaction reporting.

Although we have used the UK for both examples, the same applies for for those firms reporting to an EEA regulator. Qomply FIRDS look up takes into account the jurisdictional complexities in determining reportability.

Frequently asked questions

XOFF indicates that the trade was executed off-venue (OTC) for an instrument that is Traded on a Trading Venue (ToTV).

In practice, XOFF is used when the instrument itself is admitted to trading or traded on an MTF, OTF, or Regulated Market, but the execution took place OTC rather than on the venue.

XXXX is used for certain OTC transactions where the instrument itself is not ToTV, but the transaction remains in-scope due to an underlying or constituent being traded on a venue.

This often applies to OTC derivatives or structures where at least one underlying or constituent is ToTV, meaning the trade must still be reported even though it is not executed on a venue and the instrument itself is not ToTV.

A simple rule is:

Use XOFF when the instrument is ToTV for the relevant regime and trade date.

Use XXXX when the instrument is not ToTV, but the trade is reportable because at least one underlying or constituent is ToTV, or due to regime-specific logic.

Accurate population requires checking instrument reference data and applying the correct logic for the reporting jurisdiction.

Yes. ToTV scope is jurisdiction-dependent.

For example, an instrument may be considered ToTV in the EU regime based on EEA trading venues, while the UK FCA regime may assess ToTV differently depending on UK trading venues and the applicable post-Brexit rules.

This can cause differences in whether XXXX or XOFF should be used for the same instrument depending on the reporting obligation.

No. A Systematic Internaliser (SI) is not a trading venue (it is not an MTF, OTF, or RM).

So SI execution alone does not mean an instrument is ToTV. The ToTV assessment should be driven by whether the instrument is traded on a qualifying trading venue, based on reference data and the applicable regime rules.

Common errors include:

1) Using XOFF when the instrument is not ToTV.

2) Using XXXX without evidence that at least one underlying or constituent is ToTV.

3) Applying the wrong jurisdictional logic (UK vs EU), particularly after corporate actions, venue changes, or reference-data updates.

4) Relying solely on vendor logic without independent validation against reference data and the regulatory rules.

To reduce regulatory risk, firms should implement controls that:

Validate ToTV logic against reference data on the trade date.

Apply consistent jurisdiction rules for UK vs EU reporting.

Reconcile what was submitted versus what was accepted by the regulator or ARM.

Track root causes for recurring issues and map them back to upstream data sources.

Qomply supports this through forensic-level data quality checks and reporting assurance workflows.

Have more questions or want to see how Qomply Solutions can help?

Request a Demo