Background

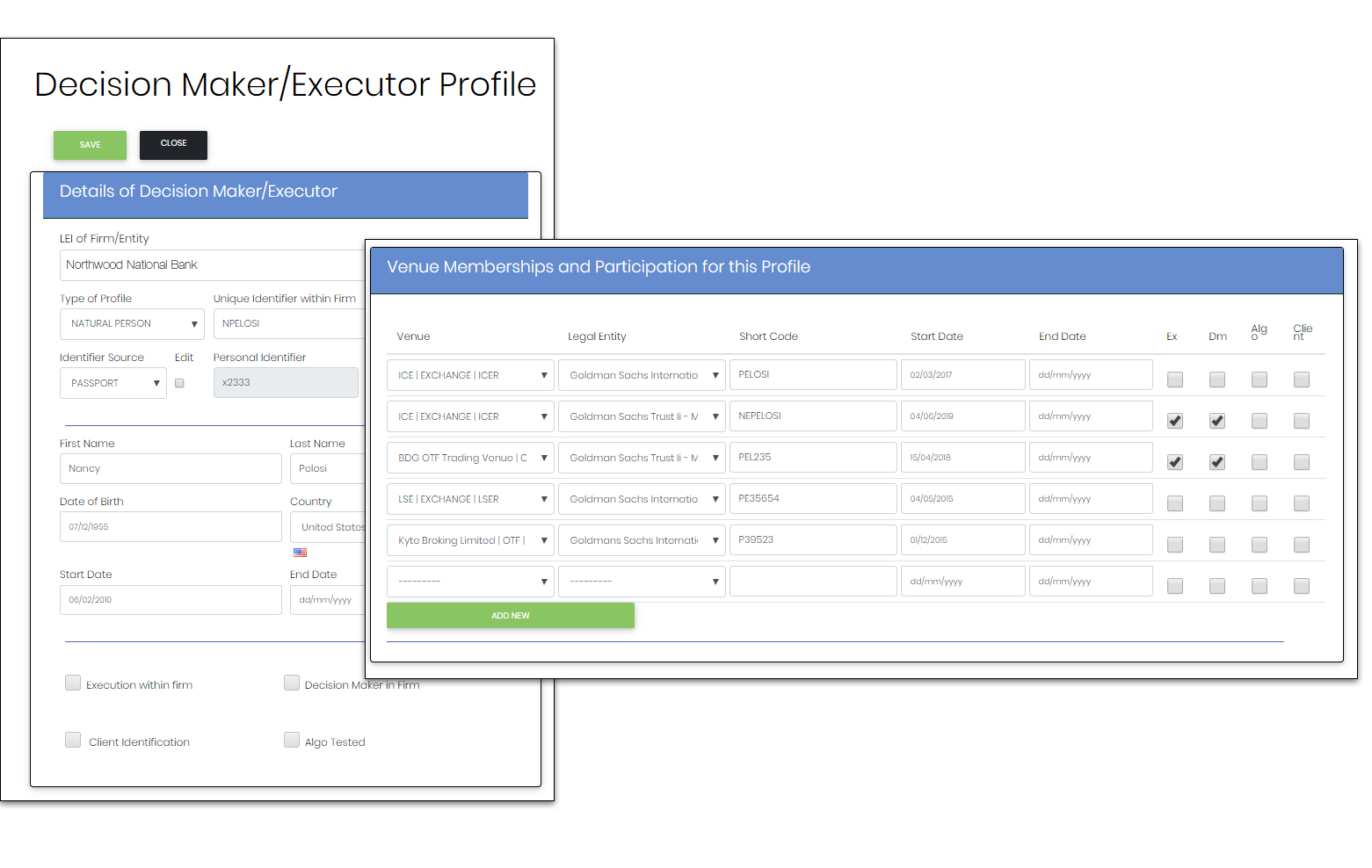

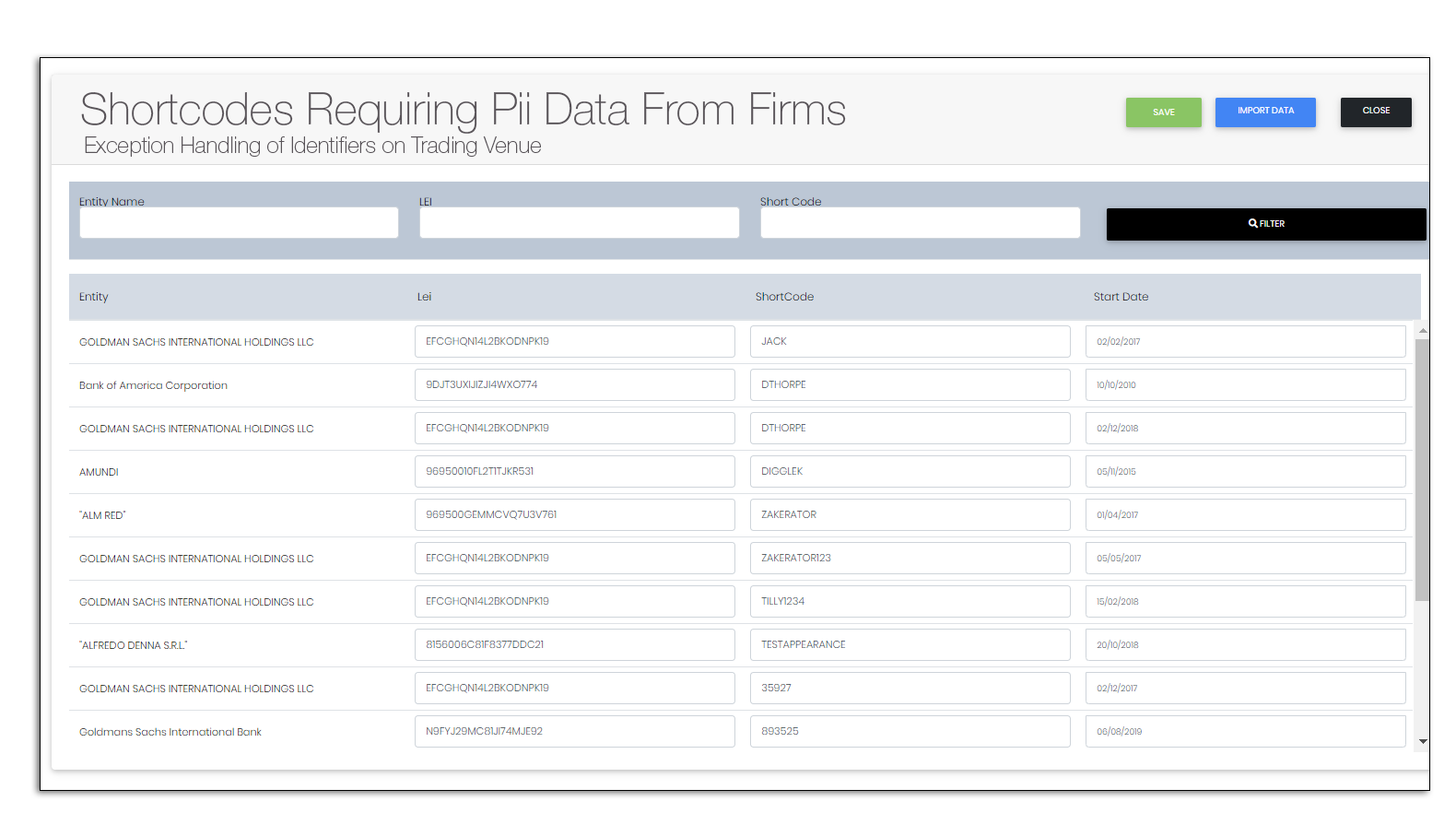

The MiFID II Record Keeping Regulation (RTS24) requires all exchanges and trading venues to collect the personal sensitive data (DOB, passport no, NI, etc) of decision makers employed by investment firms operating on its platforms.

In theory, that sounds straight-forward - in reality, it’s a mess. Each exchange and trading venue has its own unique data delivery, format and collection framework to obtain this data from investment firms. There is no recognised standard format, communication channel, or delivery mechanism. Therefore, investment firms have had to conform to the requirement of each exchange.

Data Protection/Data Privacy and GDPR further complicate the landscape as these regulations prevent the distribution of personal sensitive data, if its not required.

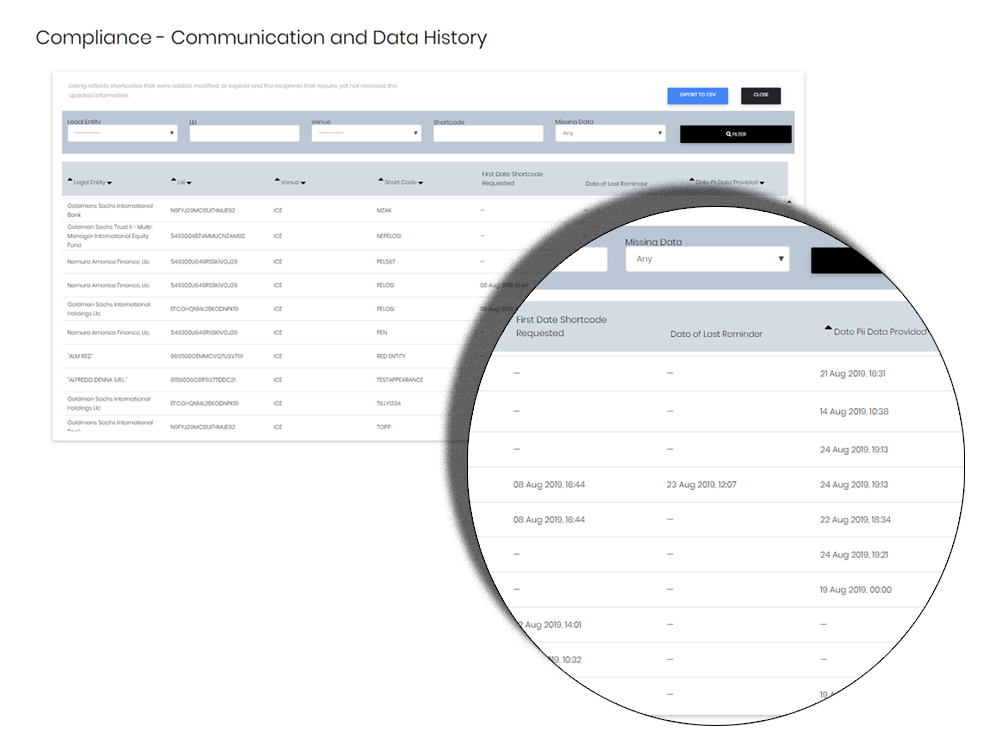

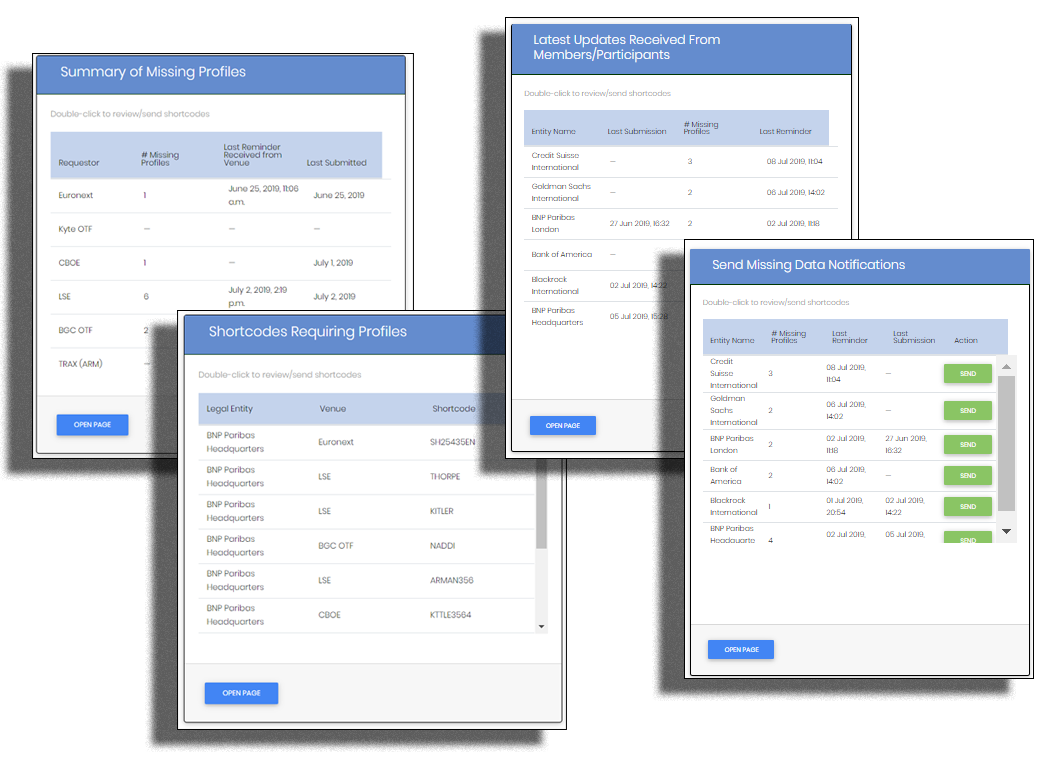

Today, firms still struggle to effectively identify the required data, send it to the trading venue, and resolve/monitor issues in a manner specific to each trading venue.

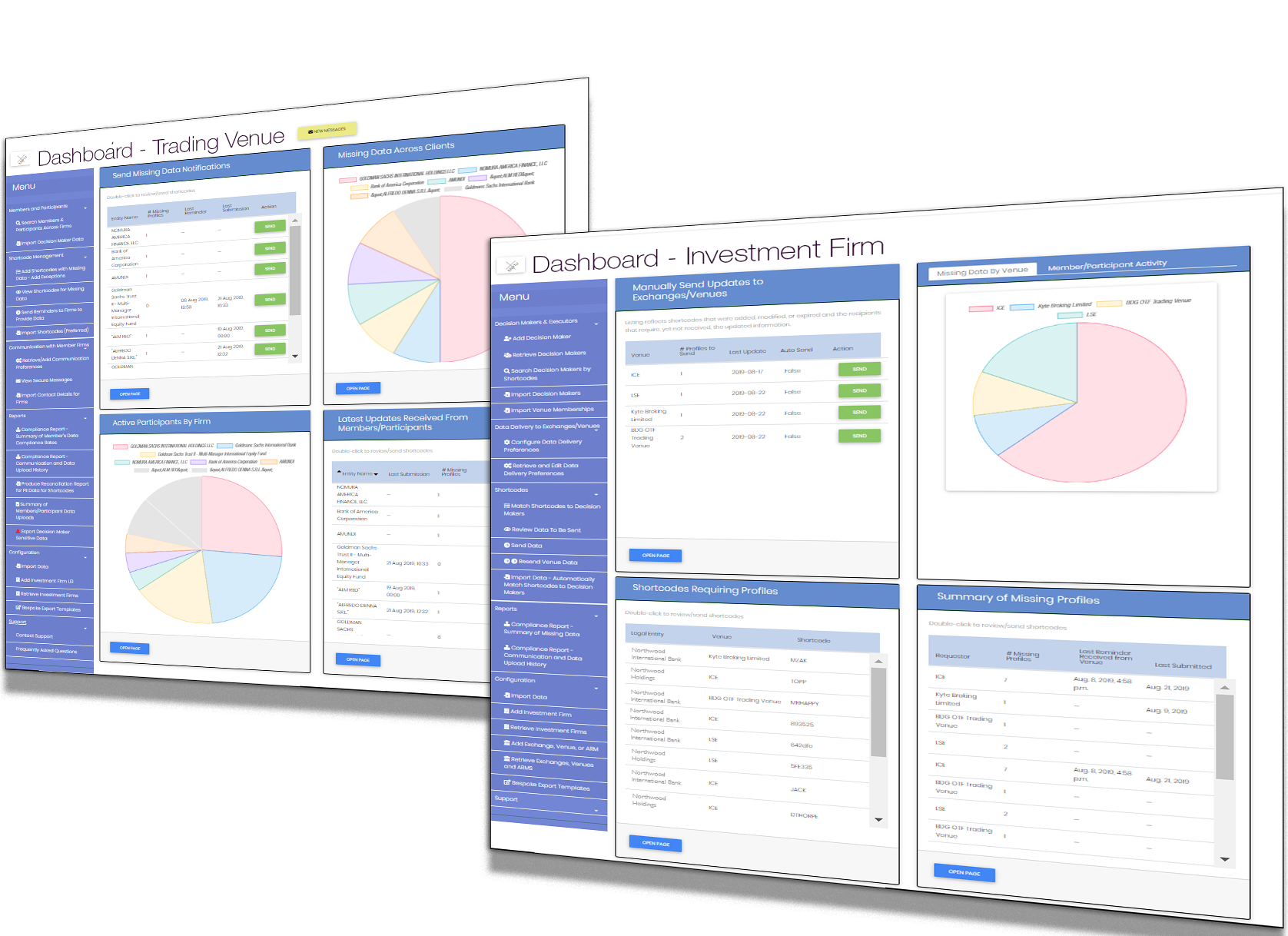

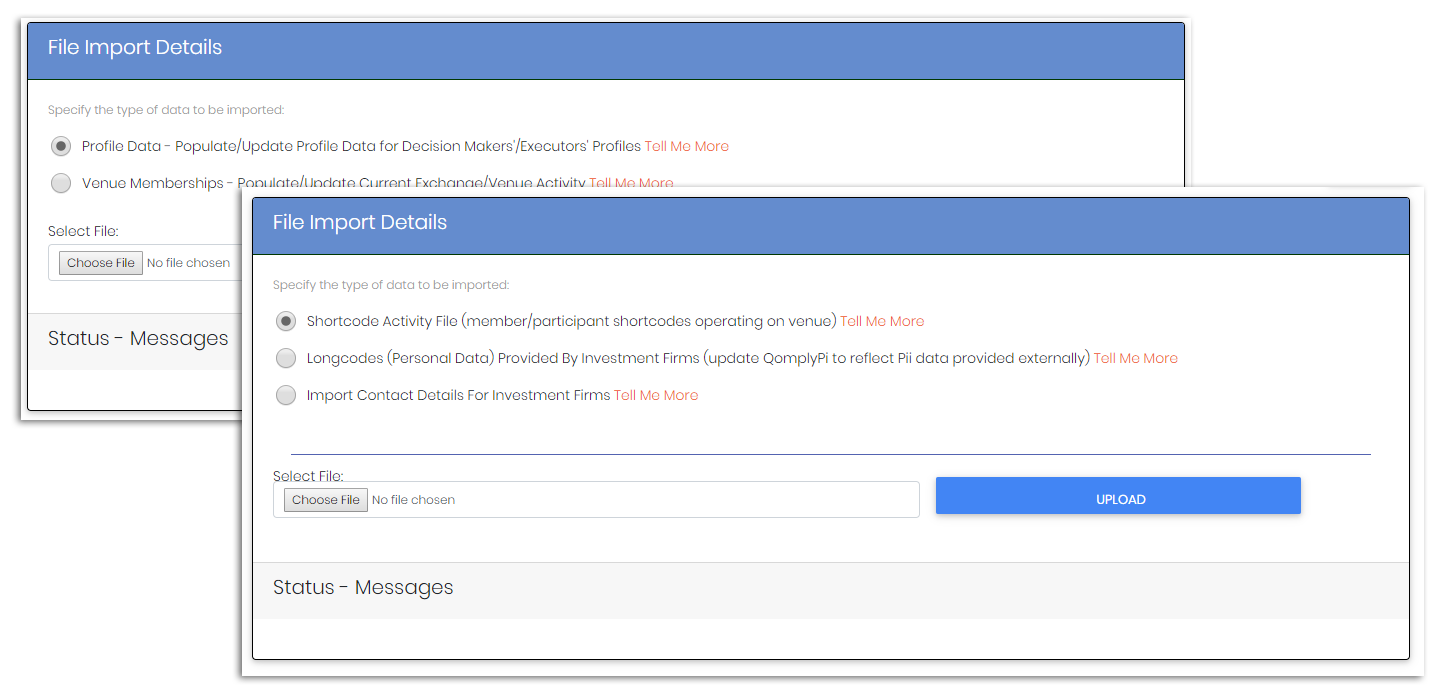

QomplyPi is a cloud-based solution that centralises Personally Identifying Information (Pii), more commonly referred to as sensitive data, so as to control maintenance, distribution, and the chain of processing of the data.

Through the QomplyPi controlled environment, trading venues communicate directly with investment firms regarding the data they require. Investment firms, within the QomplyPi platform, can then enter, process, and transmit the Pii data directly to the exchange.

Investment firms enter their Pii data once and securely distribute to all trading venues and authorised recipients requiring the data.

Financial system integration eases interaction with exchanges and venues – Communicate directly, securely, and in a controlled environment

Financial system integration eases interaction with exchanges and venues – Communicate directly, securely, and in a controlled environment