Streamlining Quality Assurance

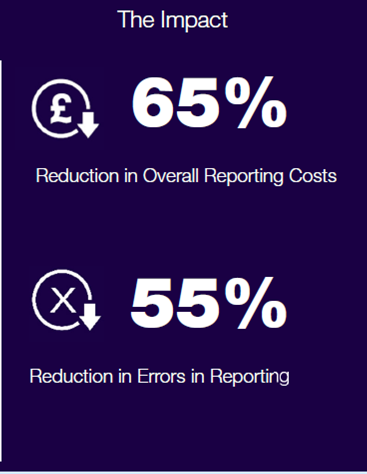

Large Investment Bank Significantly Improves Reporting Quality Whilst Reducing Costs

Learn more about how Qomply enabled a large Investment Bank to reduce costs, improve staff retention and deliver more accurate and reliable MiFID II and EMIR Refit Transaction Reporting.