The Importance of Reconciling and Auditing Transactions

6 May 2020

After more than two years, financial service firms are getting their collective head's around the transaction reporting regime. Or at least that is what we would like to think. An FOI request from the FCA reveals a different picture:

-15% of UK investment firms have admitted errors in transaction reporting to the FCA

-223 firms have been contacted by the FCA about possible reporting errors

These figures imply that about 20% of firms have been in discussion with the FCA regarding transaction reporting errors. But this may only be the tip of the iceberg.

The MiFID 2 requirements include the obligation to reconcile the data held in a firm's front office system with the data sent to their competent authority as stated in Article 15 of this Delegated Regulation:

The solution the FCA has provided for this is the MDP (Market Data Processor) system. A firm registers with the FCA and requests a sample of transaction report data to use in a reconciliation. As of November 2019, only 18% of MiFID firms had requested reconciliation data. This must surely present a red flag and an easy target for the FCA to use to identify firms that are struggling with transaction reporting obligations.

See also:

Blog: FCA hints at enforcement for key areas : Part 1

Blog: FCA hints at enforcement for key areas : Part 2

Blog Home All Blog Entries

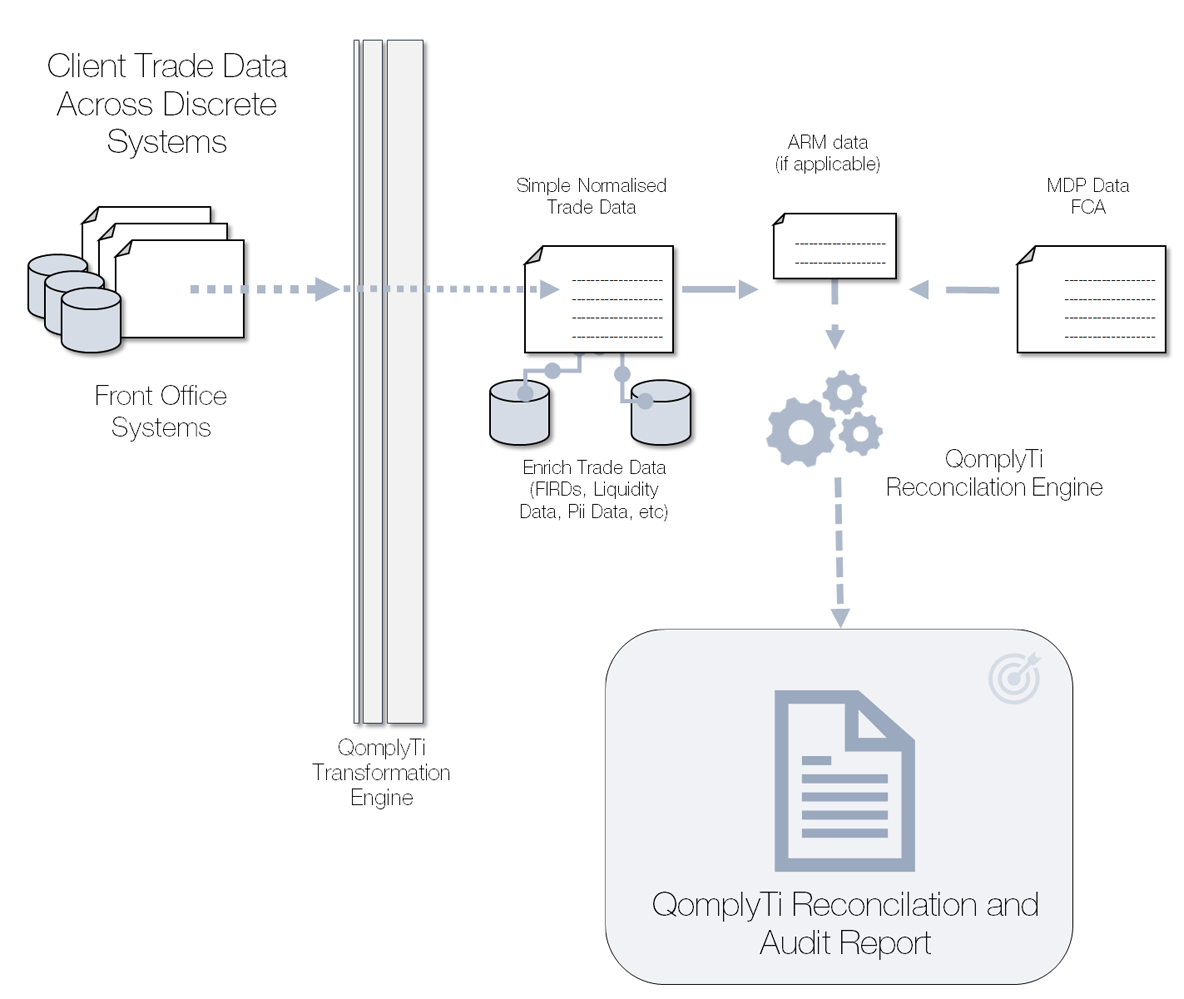

Front Office Systems

An important point to note is that the regulation requires a reconciliation with Front Office systems. This is not necessarily the same data as that provided to an ARM. The implication of the regulation is that reconciliation is to take place between the raw transaction data as entered by front office staff that has not been processed before submission to an ARM. This would give firms to opportunity to identify transactions that are not being reported and establish why that is the case.

The reconciliation process looks like this:

This mandated reconciliation process appears to have slipped under the radar of a lot of firms. The use of an ARM does not address the requirement to reconcile directly with a firm's front office systems. Firms need to address this issue themselves.

Practically, firms face reconciling their data against yet another data format. Once a reconciliation is produced, the results should be actionable and aid in any required back reporting. There may be an advantage in using a tool specially designed to reconcile transaction reports. Generic reconciliation tools can take a considerable amount of effort to set up and will impact on already stretched development teams. And the use of an independent tool may reduce the risk of 'marking your own homework' and give a true reflection of transaction reporting validity.